Antwort How much money one can transfer? Weitere Antworten – How much money can you transfer at once

Bank transfer limits

| Type of transfer | Transfer limit |

|---|---|

| ACH Same Day transfer | Up to $1,000,000 |

| Bank of America Corp. | $3,500 per day or $10,000 per week |

| JPMorgan Chase & Co. | Up to $25,000 per day |

| Citigroup Inc. Standard ACH | Up to $10,000 per day |

NEFT/RTGS/IMPS Charges, Timings, Limits

| Transaction Limits/Timing | 01.00 hours – 19.00 hours | 00.00 hours – 01.00 hours and 19.00 hours – 00.00 hours |

|---|---|---|

| Minimum | ₹ 1 | ₹ 1 |

| Maximum | ₹ 10 lakh or ₹ 1 crore (based on customer segment) | ₹ 2 Lakh |

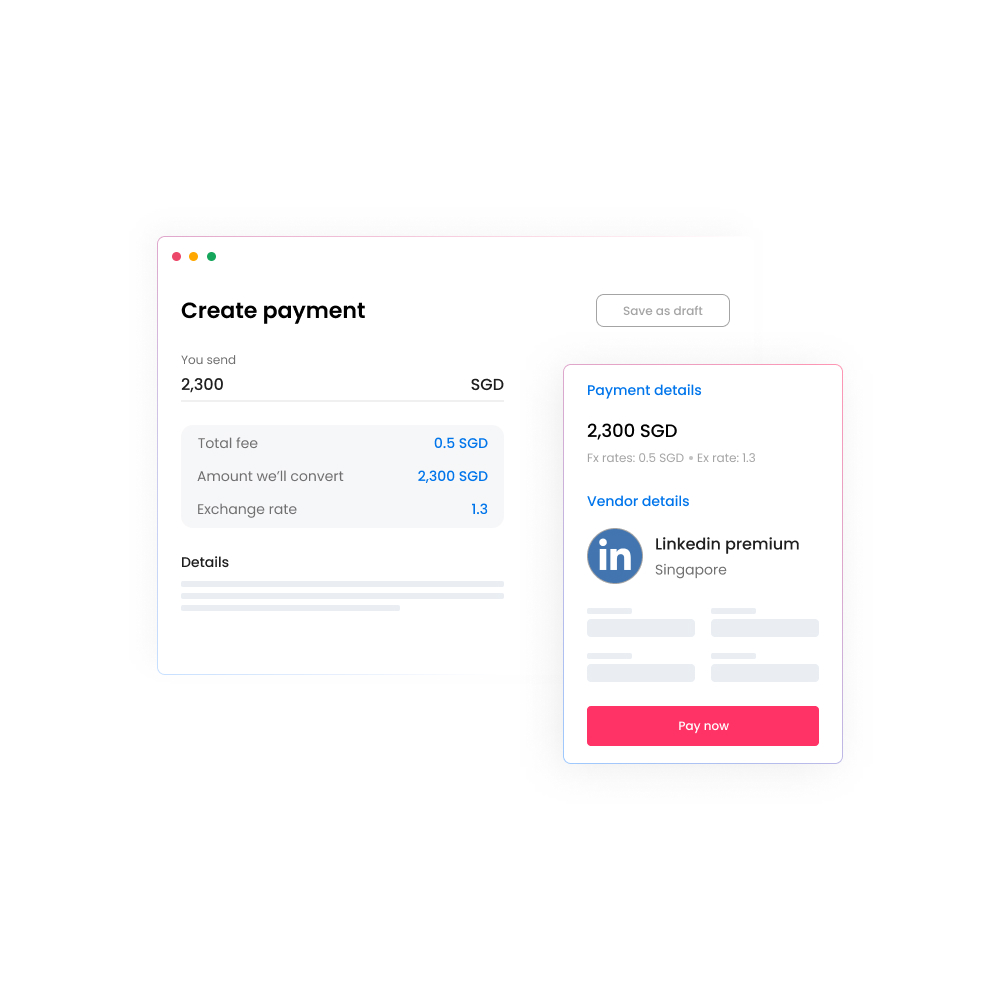

Yes, you can transfer money from one bank to another. There are many ways to do this, including using your bank's website or mobile app, a personal check, a cashier's check, a wire transfer or an ACH transaction. There are pros and cons to each method, and some come with transfer fees.

How much money can I transfer in a single day : The UPI transaction limit per day is set at ₹1 lakh by NPCI, but it may vary from bank to bank. Some banks may also have weekly or monthly limits on UPI transactions. The UPI daily limit is the maximum amount of money that can be transferred through UPI in a day.

What happens if you transfer more than $10000

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

Can I transfer 100000 at a time : A user can send up to Rs 100,000 per transaction and a maximum of Rs 100,000 per day for one bank account. This limit is available per bank account linked on BHIM. Here are important FAQs on BHIM transactions.

Under the Bank Secrecy Act of 1970, financial institutions must report wire transfers over $10,000 to the IRS. The Act is designed to flag criminal activity and does not impact the average consumer. It's up to consumers to work with a credible financial institution.

A CHAPS payment is a same-day transfer between banks that can be used for large amounts of money.

What is the safest way to transfer $100000

Wire transfers at a bank are ideal for securely sending large amounts domestically or internationally.If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.While the general rule is that wire transfers over $10,000 must be reported to the IRS, there are some exceptions to this requirement. These include: Transactions that are conducted by financial institutions on behalf of the US government. Transactions that are conducted between financial institutions.

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

What happens if I transfer $10000 : Under the Bank Secrecy Act of 1970, financial institutions must report wire transfers over $10,000 to the IRS. The Act is designed to flag criminal activity and does not impact the average consumer. It's up to consumers to work with a credible financial institution.

Can I transfer 10k to a friend : Under the Bank Secrecy Act of 1970, financial institutions must report wire transfers over $10,000 to the IRS. The Act is designed to flag criminal activity and does not impact the average consumer. It's up to consumers to work with a credible financial institution.

Can I transfer a large amount of money online

A CHAPS payment is a same-day transfer between banks that can be used for large amounts of money. If you need to pay someone straight away or transfer a large amount of money, CHAPS transfers allow you to make same-day, high-value electronic payments.

In summary, wire transfers over $10,000 are subject to reporting requirements under the Bank Secrecy Act. Financial institutions must file a Currency Transaction Report for any transaction over $10,000, and failure to comply with these requirements can result in significant penalties.Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

What happens if I deposit 40000 cash : Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.