Antwort How do you create shareholder value? Weitere Antworten – What is the formula for shareholder value

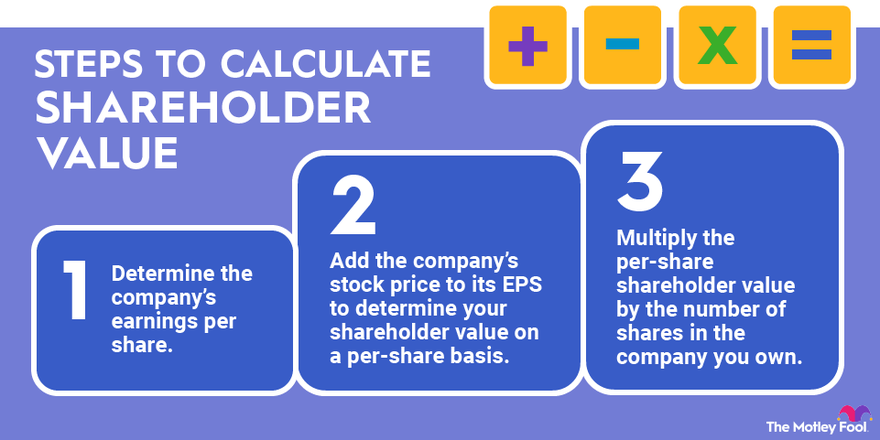

Here's how to compute your portion of shareholder value: Determine the company's earnings per share. Add the company's stock price to its EPS to determine your shareholder value on a per-share basis. Multiply the per-share shareholder value by the number of shares in the company you own.Assume, for example, that a plumbing company uses a truck and equipment to complete residential work, and the total cost of these assets is $50,000. The more sales the plumbing firm can generate using the truck and the equipment, the more shareholder value the business creates.Definition. Shareholder value creation is the process by which the management of a company uses the equity capital contributed by the shareholders to make and implement strategic and financing decisions that will increase the wealth of shareholders in excess of what they have contributed.

What are the 7 drivers of shareholder value analysis : The value driver model is a comprehensive approach that centers on seven key drivers of shareholder value i.e. sales growth rate, operating profit margin, cash tax rate, fixed capital needs, working capital needs, cost of capital and planning period or value growth duration[11].

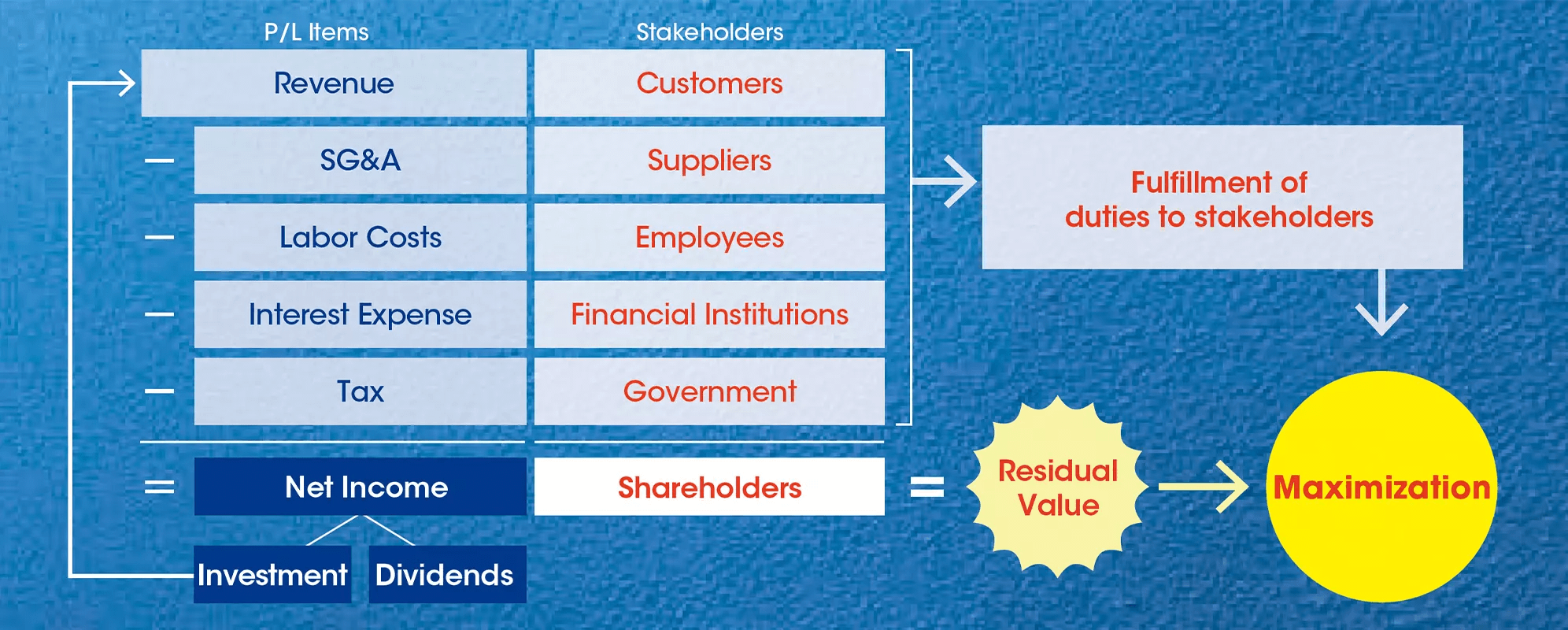

What is the difference between shareholder value and stakeholder value

Shareholders are always stakeholders in a corporation, but stakeholders are not always shareholders. A shareholder owns part of a public company through shares of stock, while a stakeholder has an interest in the performance of a company for reasons other than stock performance or appreciation.

What are the five basic drivers of shareholder value : Basic drivers of shareholder value

- Revenue.

- Operating margin.

- Cash tax rate.

- Incremental capital expenditure.

- Investment in working capital.

- Cost of capital.

- Competitive advantage period.

Shareholder value is important because it signals a company's ability to create profits and returns for its investors, measures its financial health and affects what kind of investment risks it's taking.

There are seven drivers through which a company can maximize its shareholder value. These drivers are revenue, cash tax rate, operating margin, cost of capital, investment in WC (working capital), incremental CE (capital expenditure. read more), and competitive advantage.

What is the best indicator of shareholder wealth

In this article, you will learn about some of the best ways to measure shareholder value in a deal, and how to use them effectively.

- 1 Earnings per share.

- 2 Free cash flow.

- 3 Economic value added.

- 4 Market value added.

- 5 Total shareholder return.

- 6 Here's what else to consider.

SVA assumes that the value of a business is the net present value of its future cash flows, discounted at the appropriate cost of capital. Once the value of a business has been calculated in this way, the next stage is to calculate shareholder value using the equation: shareholder value = value of business – debt.The definition of Shareholder Value is the value of the company (firm) minus the Future claims (debts). The value of the company can be calculated as the Net Present Value of all future cashflows plus the value of the nonoperating assets of he company.

(B) 10-Percent shareholder The term “10-percent shareholder” means— (i) in the case of an obligation issued by a corporation, any person who owns 10 percent or more of the total combined voting power of all classes of stock of such corporation entitled to vote, or (ii) in the case of an obligation issued by a …

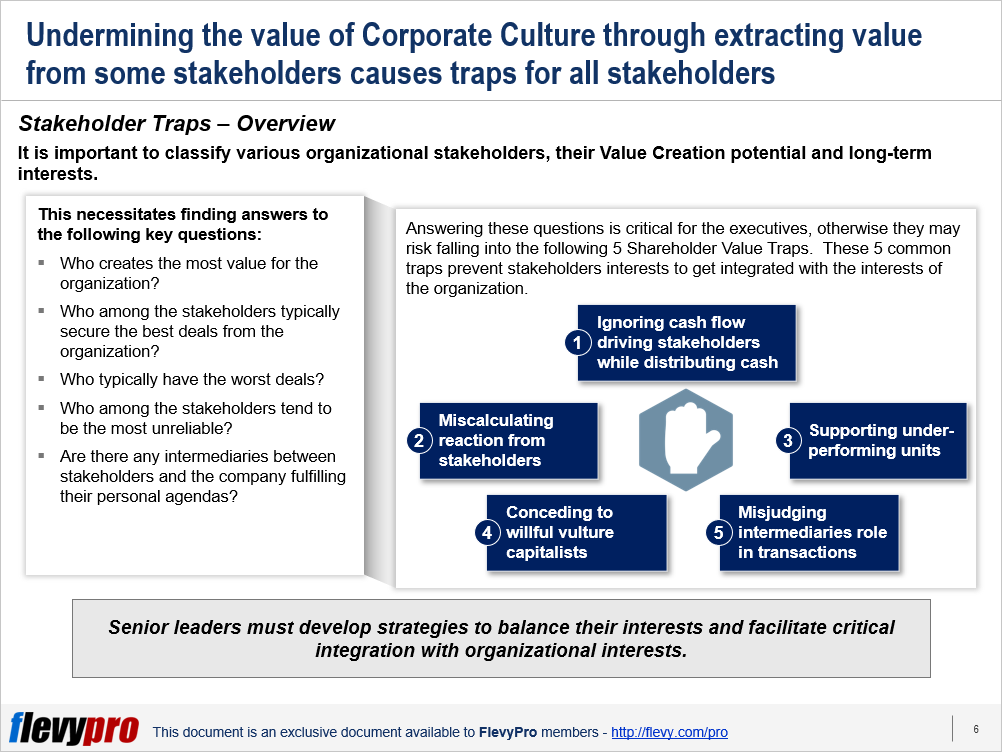

How company executives create the most value for all stakeholders :

- Do not manage earnings or provide earnings guidance.

- Make strategic decisions that maximize expected value, even at the expense of lowering near-term earnings.

- Make acquisitions that maximize expected value, even at the expense of lowering near-term earnings.

- Carry only assets that maximize value.

How do you create value in a company : Company value creation is an ongoing process, which includes:

- creating or expand recurring revenue streams,

- increasing expected future revenue growth rate,

- increasing returns on existing assets,

- discontinuing poor performing activities,

- reducing non-cash excess working capital,

- creating or expand barriers to entry,

What is the simplest and best measure of stockholder wealth

Answer and Explanation:

The market price is the best measure of the shareholders' wealth. Market capitalization is the product of the outstanding shares and the market price per share, indicating the firm's actual value.

Price-to-earnings ratio (P/E): Calculated by dividing the current price of a stock by its EPS, the P/E ratio is a commonly quoted measure of stock value. In a nutshell, P/E tells you how much investors are paying for a dollar of a company's earnings.By 2019, maximizing shareholder value has come to be seen as leading to a toxic mix of soaring short-term corporate profits, astronomic executive pay, along with stagnant median incomes, growing inequality, periodic massive financial crashes, declining corporate life expectancy, slowing productivity, declining rates of …

Does positive NPV increase shareholder wealth : shareholder wealth The NPV technique measures the present value of the future cash flows that a project will produce. A positive NPV means that the investment should increase the value of the firm and lead to maximizing shareholder wealth.